Career Change Resume Examples for 2026 (+Templates & Tips)

You're about to change your career. Learn how to write a career change resume that will get you the dream job.

Tom Gerencer

Career Expert

The claims adjusting field can be competitive, so your claims adjuster resume needs to make a strong impression on recruiters. This guide will help negotiate your next employment.

Investigating claims and identifying fraudulent ones doesn’t take you much time. You immediately know how to evaluate insurance requests and make informed decisions about the settlement.

But now the tables have turned. You’re applying for a new claims adjuster role, and your employment is contingent on someone else’s judgment. For insurance, make a first-rate claims adjuster resume that leaves no illusions and gets you the job.

In this guide:

Save hours of work and get a job-winning resume like this. Try our resume builder with 20+ resume templates and create your resume now.

What users say about ResumeLab:

I had an interview yesterday and the first thing they said on the phone was: “Wow! I love your resume.”

Patrick

I love the variety of templates. Good job guys, keep up the good work!

Dylan

My previous resume was really weak and I used to spend hours adjusting it in Word. Now, I can introduce any changes within minutes. Absolutely wonderful!

George

Want to research resumes for similar positions? Check these guides:

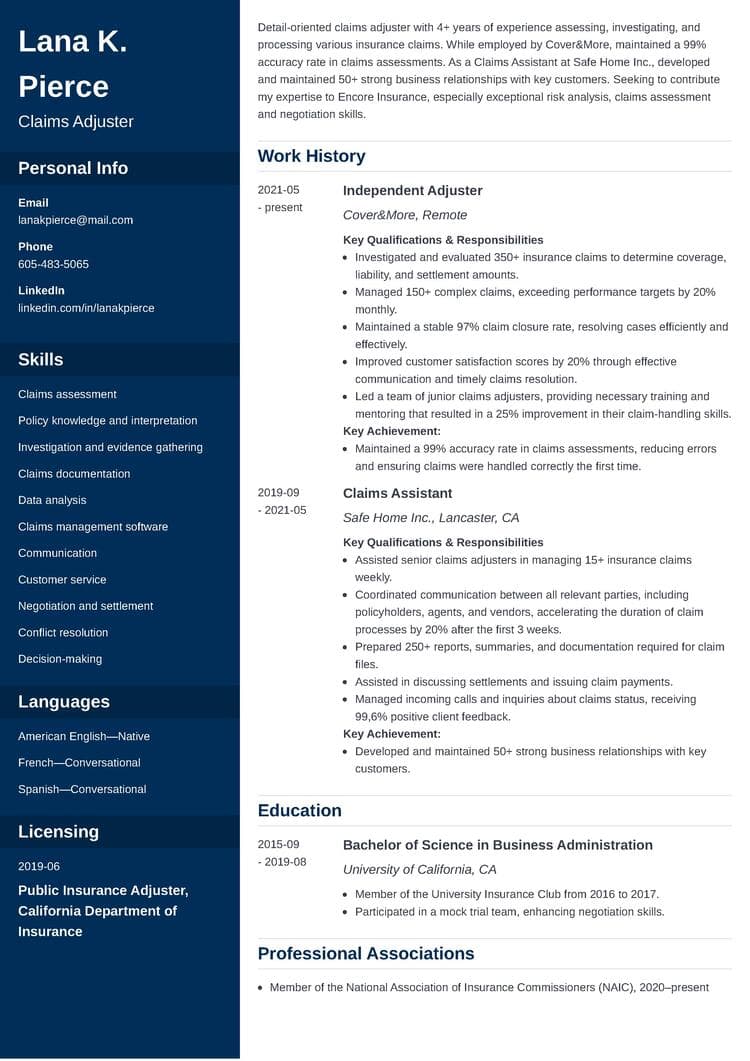

Lana K. Pierce

Claims Adjuster

605-483-5065

lanakpierce@mail.com

linkedin.com/in/lanakpierce

Summary

Detail-oriented claims adjuster with 4+ years of experience assessing, investigating, and processing various insurance claims. While employed by Cover&More, maintained a 99% accuracy rate in claims assessments. As a Claims Assistant at Safe Home Inc., developed and maintained 50+ strong business relationships with key customers. Seeking to contribute my expertise to Encore Insurance, especially exceptional risk analysis, claims assessment and negotiation skills.

Experience

Independent Adjuster

Cover&More, Remote

May 2021–present

Key Qualifications & Responsibilities

Key Achievement:

Claims Assistant

Safe Home Inc., Lancaster, CA

September 2019–May 2021

Key Qualifications & Responsibilities

Key Achievement:

Education

Bachelor of Science in Business Administration

University of California, CA

September 2015–August 2019

Skills

Licensing

Professional Associations

Languages

Claims adjusters evaluate claims on behalf of insurance companies. They are decisive in determining coverage and facilitating the settlement of claims for policyholders. A claims adjuster's resume aims to prove you can resolve claims quickly and provide high customer service to clients.

Here’s a breakdown of how to write and what to include in a resume for a claims adjuster:

As a professional claims adjuster, you always have the right documentation at hand. Without clear documents, specifically claim files, it would be impossible to showcase how you reached the correct decision in the right manner.

With some essential documentation-making practice, writing and formatting your claims adjuster resume shouldn’t be a worry.

Here are some best resume formatting practices to make your document up to standards:

If you use a resume builder, you’ll get to decide whether you want to save your resume in PDF or DOC. PDFs are generally the preferred format for submitting your application, however, it’s good to check the specific requirements outlined in the job posting.

Being a claims adjuster can be a challenging profession. Mastering complex claims and keeping up with tight deadlines often get your head spinning. But with the ability to handle pressure, you find success and fulfilment in your profession.

Convey it in the first lines of your resume to catch the recruiters’ attention and hit the ground running.

Here’s how to create a killer resume summary for a claims adjuster:

A good and a bad example might help to illustrate what to aim for when creating a claims adjuster resume summary:

Summary

Detail-oriented claims adjuster with 4+ years of experience assessing, investigating, and processing various insurance claims. While employed by Cover&More, maintained a 99% accuracy rate in claims assessments. As a Claims Assistant at Safe Home Inc., developed and maintained 50+ strong business relationships with key customers. Seeking to contribute my expertise to Encore Insurance, especially exceptional risk analysis, claims assessment and negotiation skills.

Summary

Experienced claims adjuster working more than 4 years in the field. Adept in investigating and processing various insurance claims. I handled numerous insurance claims during my previous employment and took care of long business relationships. I’d gladly join Encore Insurance to use my excellent communication and negotiation skills.

What’s wrong with the bad example? When crafting your resume summary, avoid using generic statements that don't provide specific information about your qualifications. Phrases like excellent communication skills are overused and lack specificity.

Experienced claims adjusters with a strong track record of success generally face less competition for specialized positions. But what if you’re a claims adjuster with no experience and are interested in an entry-level claims adjuster role?

Choose a resume objective instead. It can help clarify your career goals and highlight what you hope to achieve in a chosen career.

Objective

Analytical recent graduate with a Bachelor’s degree in Business Administration, eager to launch a career as a claims adjuster at B&J Insurance. During my internship at General Insurance, maintained detailed files, including claim documents and correspondence, with supreme accuracy. Seeking an opportunity to apply my strong problem-solving skills and commitment to fairness at B&J Insurance and help people deal with stressful situations.

Objective

Motivated recent Business Administration graduate, eager to join B&J Insurance as a claims adjuster. During my internship at General Insurance, maintained claim documents and helped senior claims adjusters with various tasks. I believe my great problem-solving skills will be valuable for your company.

Again, the difference lies in precision. Vague sentences aren’t likely to catch a recruiter’s attention, while concrete examples of your first experiences might help to make a good impression on a potential employer.

You’re unquestionably a negotiation expert, assessing and settling insurance claims fairly and efficiently. But let’s face the truth: resume writing has no room for negotiations. A resume document undergoes strict rules, and adapting to them often determines your success in the recruitment process.

The work experience section is crucial to a claims adjuster's resume. It’s where you emphasize your professional accomplishments and your specific impact on previous employers or clients.

Here’s how to make a fairly good claims adjuster job description:

Use the below examples for a better understanding:

Experience

Independent Adjuster

Cover&More, Remote

May 2021–present

Key Qualifications & Responsibilities

Key Achievement:

Experience

Independent Adjuster

2021–until now

Key Qualifications & Responsibilities

There are several common things that applicants often need to correct in their job descriptions. One of these pitfalls is requiring more specific and quantifiable achievements. Don’t omit relevant metrics—numbers make your accomplishments more impressive and tangible.

A claims adjuster skills list could be as extensive as a complicated claim report. But, claims adjusters also need to strike a balance between providing enough information and avoiding unnecessary complexity in their reports.

That’s why you must find your sweet spot when creating a claims adjuster skill set. Focus on key skills like insurance knowledge, analytical abilities, and negotiation skills, and don’t stuff your resume with overly generic skills like team player or problem solver.

Here’s an exemplary list of skills for a claims adjuster resume:

When selecting the right skills for your claims adjuster resume, remember to emphasize the skills most relevant to the specific job description, responsibilities, and requirements.

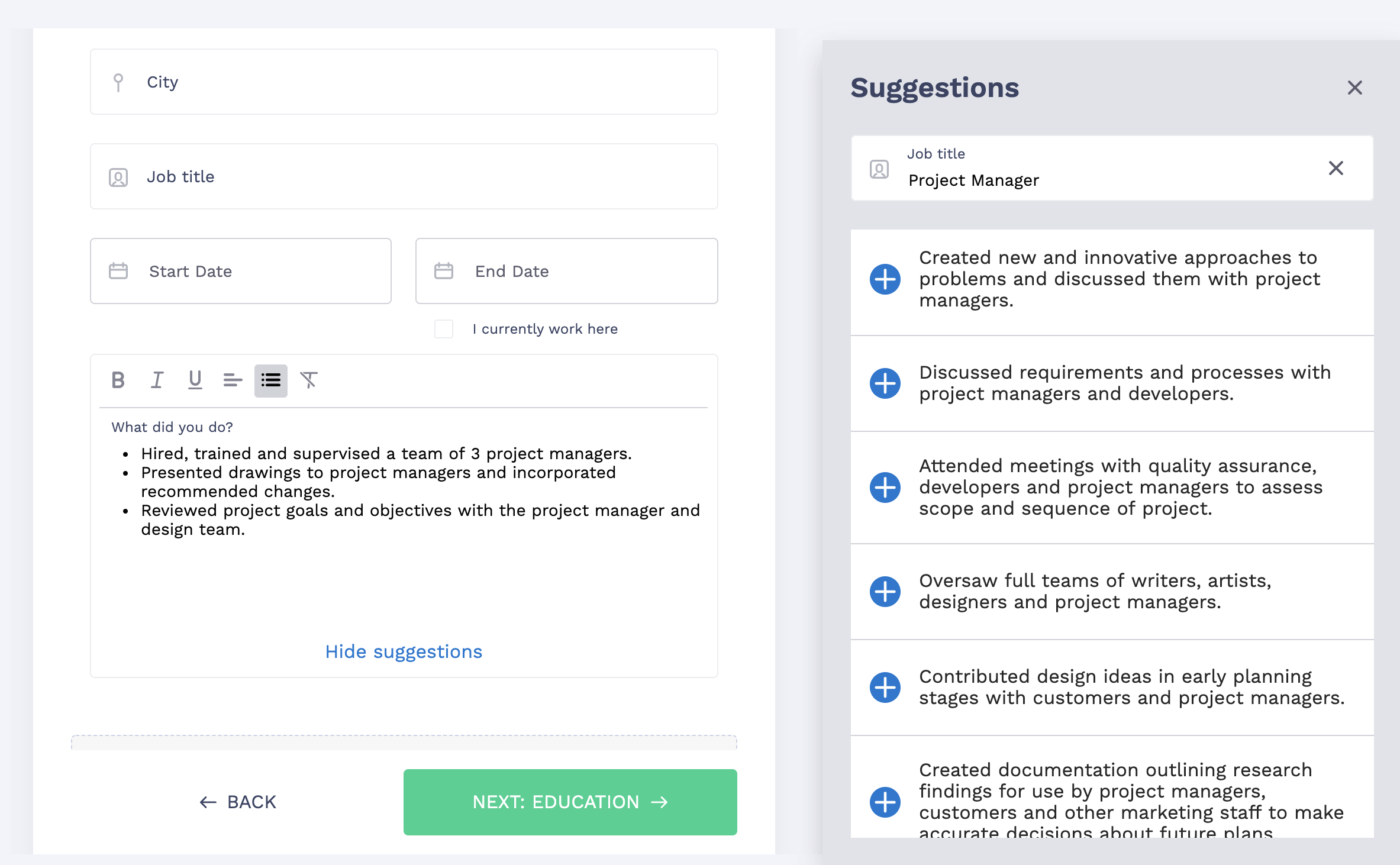

The ResumeLab builder is more than looks. Get specific content to boost your chances of getting the job. Add job descriptions, bullet points, and skills. Easy. Improve your resume in our resume builder now.

Nail it all with a splash of color, choose a clean font, and highlight your skills in just a few clicks. You're the perfect candidate, and we'll prove it. Use our resume builder now.

Entering the insurance field and holding a claims adjuster role typically requires a combination of education, training, and, most often, licensing. That’s why including all this information in your resume for a claims adjuster is critical.

Here’s an overview of what the education section in a claims adjuster resume should look like:

Education

Bachelor of Science in Business Administration

University of California, CA

September 2015–August 2019

When writing about your education, include a degree, field of study, institution, location, and studying dates. Add relevant coursework, memberships, or other extracurricular activities to make your education section more comprehensive.

Though resumes are expected to be concise and limited to one page, a few final lines of your resume should always be reserved for added sections and some extra references. Ultimately, you don’t want to be considered Tim Lippe, stuck in his comfort zone.

These are the extra sections you can attach to your claims adjuster resume:

This example is a great representation of added sections:

Licensing

Professional Associations

Languages

Whatever sections you decide to include should enhance your qualifications and make you a stronger candidate—not the other way around.

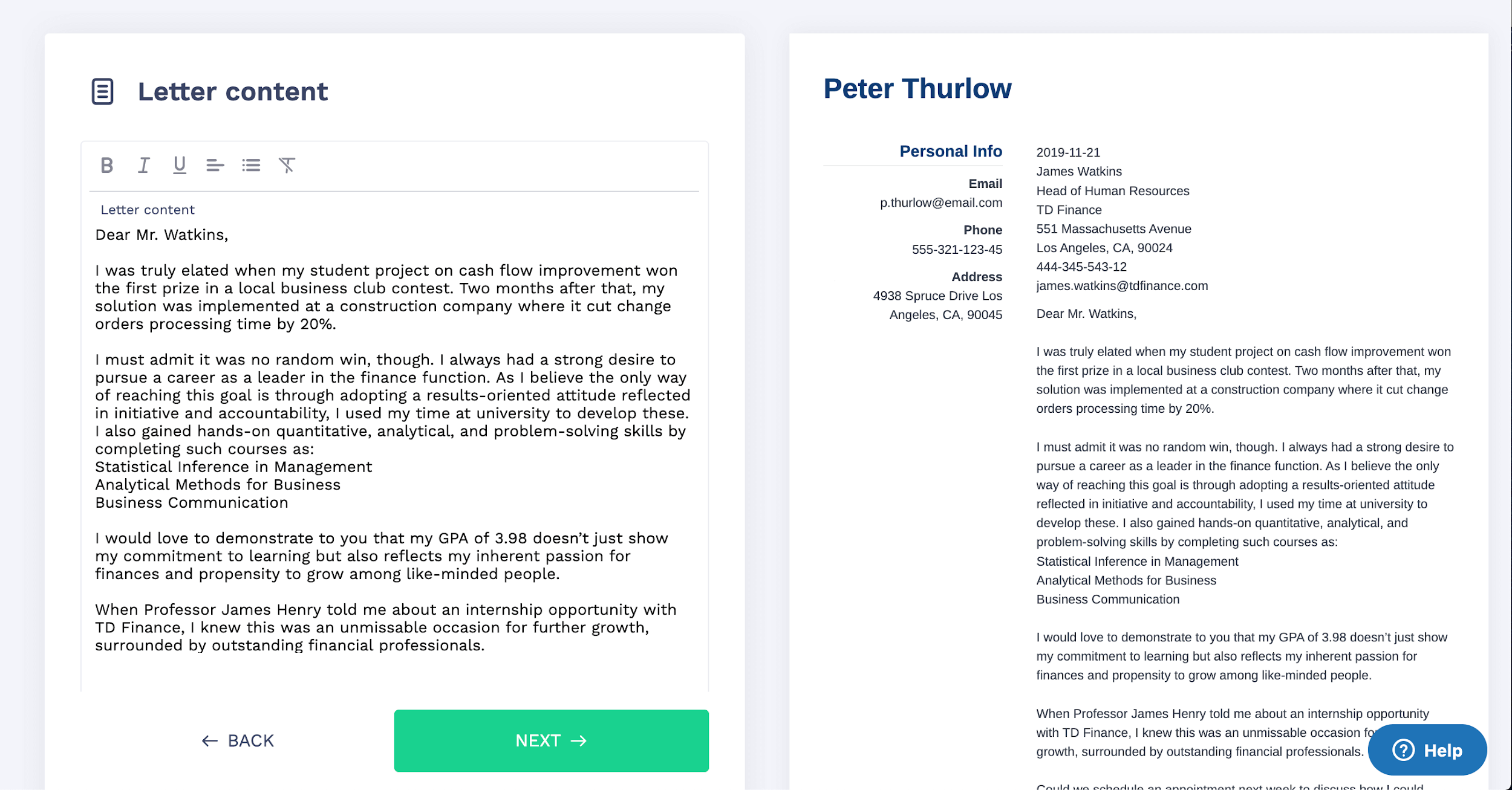

Expert Hint: Since you’re adept at writing various insurance documents, writing a matching cover letter shouldn’t be challenging. And that’s wonderful because it can boost your chances of being noticed.

Double your impact with a matching resume and cover letter combo. Use our cover letter generator and make your application documents pop out.

Want to try a different look? There's 21 more. A single click will give your document a total makeover. Pick a cover letter template here.

To make a claims adjuster resume that’s right to the point:

Do you have any questions regarding a resume for a claims adjuster? Do you need professional help when preparing your resume document? Let us know in the comments.

You're about to change your career. Learn how to write a career change resume that will get you the dream job.

Tom Gerencer

Career Expert

Learn how far back should a resume go. Find out if it’s a good idea to take a long trip down memory lane when listing your entries.

Aleksandra Makal

Career Expert

Resume AI writing is a hot topic as of late. And the growing potential of ChatGPT is stirring up the creative industry. Let's explore the pros & cons of AI tools for resume-making.

Mariusz Wawrzyniak

Career Expert