Find the Best Resume Format for You in 2026

To help you choose the best resume format, let’s first understand the differences between the three main resume formats. See the examples and make an informed choice.

Mariusz Wawrzyniak

Career Expert

![New Data On Financial Transparency At Work [2023 Report]](https://cdn-images.resumelab.com/pages/resumelab_header_1.jpg)

Gentlemen don’t talk about money, right? Wrong. Here’s how people really feel about discussing finances, pay transparency, and factors determining salary.

Money. Present in our wallets, long-term plans, and dreams. Not necessarily in open conversations and job postings, though.

Talking about money still evokes emotions, controversy, and mixed reactions. Luckily, there’s light at the end of the tunnel. With a growing number of companies required by law to disclose what they pay, financial transparency is gaining in importance.

Will it break the money taboo in the workplace and beyond? Time will tell.

But–

Before it happens, let’s focus on what’s here and now. At ResumeLab, we surveyed over 1,000 employees to examine such burning issues as:

Let’s touch the untouchable and enter the no-entry area together to see what our study revealed.

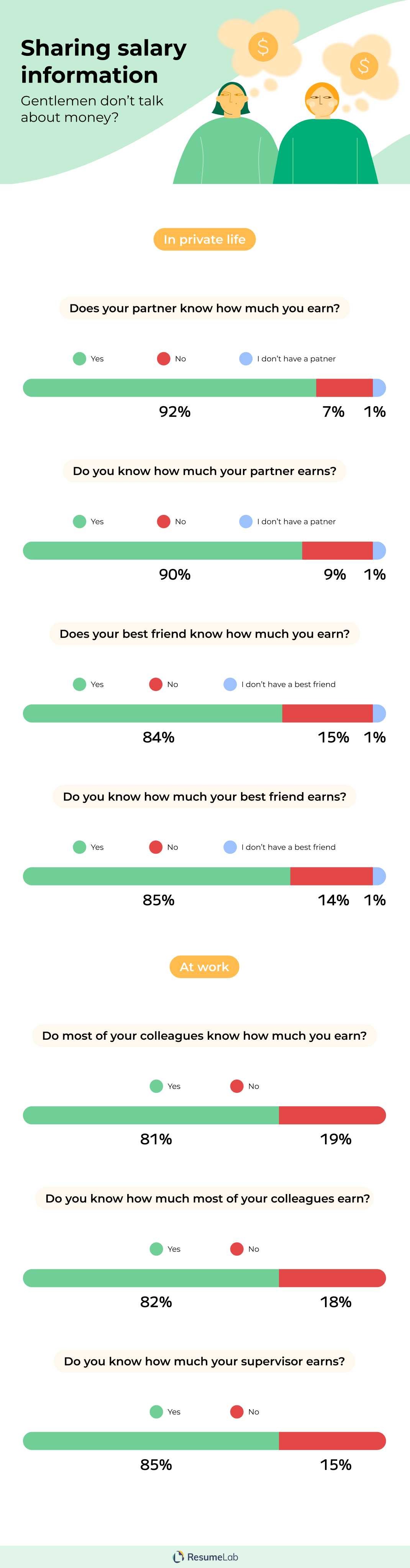

To start with, we asked respondents a few questions about sharing salary information. How open are they when talking about money? Let’s find out.

So far, so good. Time to dig deeper.

Let’s switch from a private to a professional environment now. Do the same rules apply to personal life and the workplace?

Many people do have trouble talking about finances. Still, not all of them, not in all situations, and not for the same reasons. The money taboo is a multilayered issue, depending on various factors.

It’s comforting to know that people are becoming more open about financial matters. After all, talking about money doesn’t have to make us feel ashamed, guilty, or envious.

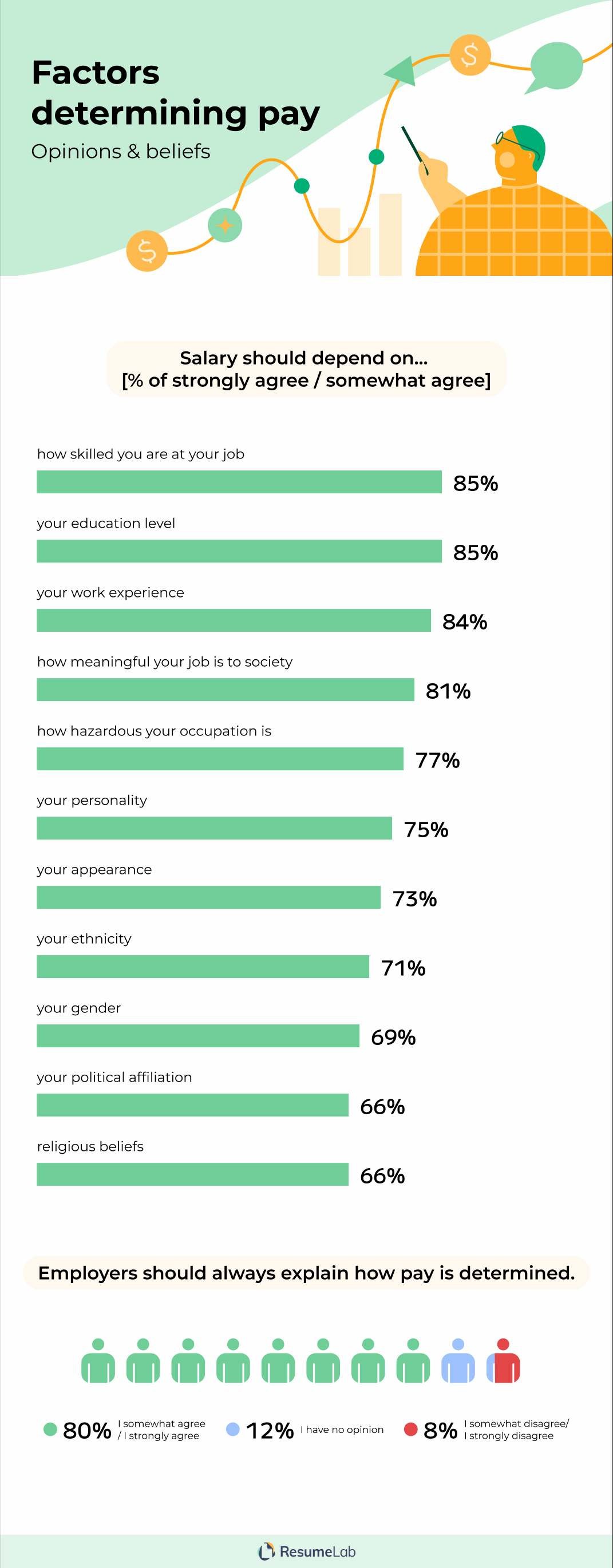

Now let’s have a closer look at factors determining one’s salary.

We also investigated opinions on factors determining pay.

According to participants, salary should depend on… [*percentage of strongly agree/somewhat agree answers]:

Some more noteworthy research findings to mention here:

Just for the record. It is illegal for an employer to publish a job advertisement that shows a preference for someone applying for a job because of his or her race, color, religion, or gender. Such practices are prohibited. Consequently, all respondents convinced that these factors should determine one’s pay were wrong, to put it mildly.

Unclear pay arrangements are just one of employers’ recruitment process sins. And, as sad as it’s true, the list doesn’t end there. Keep on reading to find out more.

Looking for a job is not a piece of cake. This is usually a time-consuming process that takes a great deal of effort, involvement, and patience.

Dozens of job postings, an endless list of responsibilities and requirements, but no information about salary. Sounds familiar? Not a surprise. Yet, it’s a glaring omission.

Julia Pollak, a chief economist at ZipRecruiter, reports that only about 12% of postings from US online job sites include salary ranges. A separate survey conducted by Joblist revealed another interesting fact. As many as 43% of hiring managers believe that disclosing salary information in job postings attracts better candidates. Well, that's not the best team play we can think of.

Why do so many employers avoid posting salary information in job offers, then? Sure, work shouldn’t be all about money but – sorry, not sorry – bills won’t pay themselves.

“Companies don’t want informed consumers… because the more informed the consumer is, the harder it is to negotiate savings of any kind. There’s definitely a mindset that the job of recruiting and hiring is to bring in the best person for not a penny more than needed. And the best way to do that is not to tell them how much you actually have available.”

Now let’s see what our respondents think about a lack of pay range in job offers.

Interestingly, there were some disparities in answers given by different demographic groups. 89% of respondents with master’s degrees agreed that a salary range was a must in job postings. At the same time, only 66% of survey takers with no college degree shared such an opinion.

Moreover, a full 80% of respondents declared it was likely they wouldn’t apply for the job because of a lack of pay information.

We also asked respondents why job postings lacked information about salary. They chose all options they agreed with. The results were as follows:

“The reason for the lack of information about salary in job postings is that…” [*percentage of strongly agree/somewhat agree answers]:

The vast majority of respondents agreed that thanks to knowing what salary is being offered (83%) and how much others are earning (81%), you are in a position to advocate for yourself as a job seeker. Also, 77% of participants believed that companies whose job postings lack information about salary couldn't be trusted.

Companies think they're being smart by refusing to disclose salaries, but candidates are onto them. The majority of them know the trick, and trust companies less as a result. So disclosing salary could actually give smart companies a competitive advantage.

Knowing what a job pays from the start makes the job-hunting process way smoother. Noteworthy, these days, candidates tend to be more selective about what roles they apply for. Consequently, salary range information can help them narrow down their options.

Let’s move on to discover even more of the research findings.

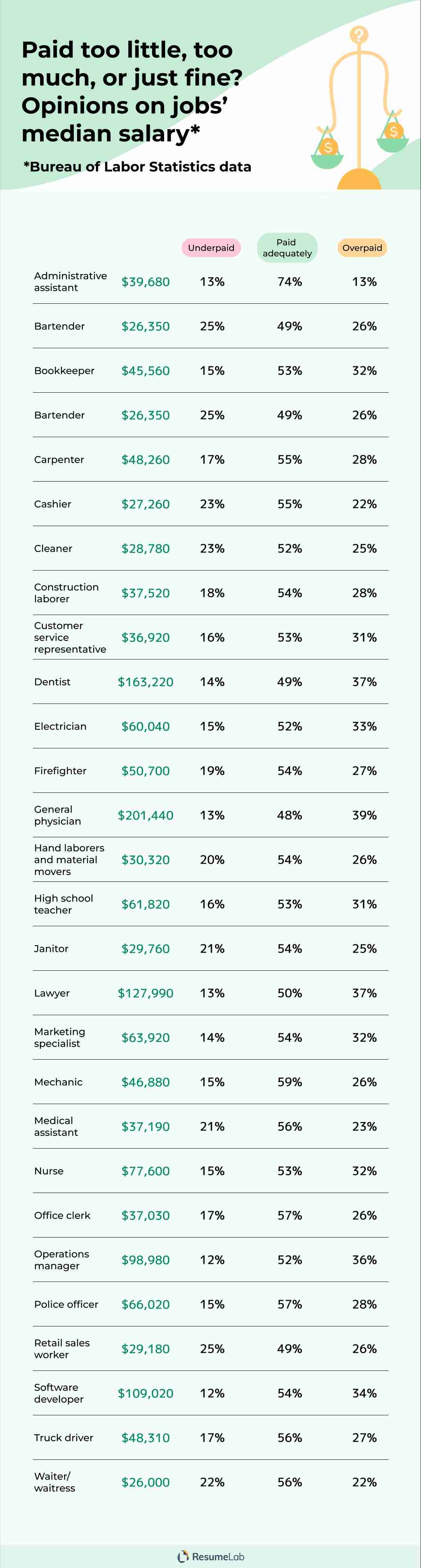

Although pay transparency hasn’t become the new normal yet, there are a few ways to learn how much money you can make in a given job. The US Bureau of Labor Statistics shares such data on its website.

We used information about median salaries and asked respondents for their opinions. Which jobs were considered overpaid or underpaid, and which paid adequately? Check yourself. The jobs are listed in alphabetical order.

Underpaid – 13% | Paid adequately – 74% | Overpaid – 13%

Underpaid – 25% | Paid adequately – 49% | Overpaid – 26%

Underpaid – 15% | Paid adequately – 53% | Overpaid – 32%

Underpaid – 17% | Paid adequately – 55% | Overpaid – 28%

Underpaid – 23% | Paid adequately – 55% | Overpaid – 22%

Underpaid – 23% | Paid adequately – 52% | Overpaid – 25%

Underpaid – 18% | Paid adequately – 54% | Overpaid – 28%

Underpaid – 16% | Paid adequately – 53% | Overpaid – 31%

Underpaid – 14% | Paid adequately – 49% | Overpaid – 37%

Underpaid – 15% | Paid adequately – 52% | Overpaid – 33%

Underpaid – 19% | Paid adequately – 54% | Overpaid – 27%

Underpaid – 13% | Paid adequately – 48% | Overpaid – 39%

Underpaid – 20% | Paid adequately – 54% | Overpaid – 26%

Underpaid – 16% | Paid adequately – 53% | Overpaid – 31%

Underpaid – 21% | Paid adequately – 54% | Overpaid – 25%

Underpaid – 13% | Paid adequately – 50% | Overpaid – 37%

Underpaid – 14% | Paid adequately – 54% | Overpaid – 32%

Underpaid – 15% | Paid adequately – 59% | Overpaid – 26%

Underpaid – 21% | Paid adequately – 56% | Overpaid – 23%

Underpaid – 15% | Paid adequately – 53% | Overpaid – 32%

Underpaid – 17% | Paid adequately – 57% | Overpaid – 26%

Underpaid – 12% | Paid adequately – 52% | Overpaid – 36%

Underpaid – 15% | Paid adequately – 57% | Overpaid – 28%

Underpaid – 25% | Paid adequately – 49% | Overpaid – 26%

Underpaid – 12% | Paid adequately – 54% | Overpaid – 34%

Underpaid – 17% | Paid adequately – 56% | Overpaid – 27%

Underpaid – 22% | Paid adequately – 56% | Overpaid – 22%

Okay. Quick analysis.

Lawyers, operations managers, marketing specialists, and nurses. An interesting combination, isn’t it? What they have in common is people’s belief that they are the most overpaid professions.

Let’s dig deeper.

Interestingly, the study didn’t reveal anything to report on the most underpaid jobs. When it comes to professions cited as adequately paid, the top four were administrative assistant, mechanic, office clerk, and police officer.

Time to drop the mike, it’s time to let our respondents speak.

The survey also included a separate section where respondents could share – in their own words – how they felt about being open while talking about money. In general, the vast majority of survey takers considered financial transparency positive and necessary. Let’s have a look at some of their responses.

“In general, I feel like greater salary transparency is a positive thing. I'd really like to know how much others of my experience level at my company are earning, because I frankly feel like I am grossly underpaid.”

“I think it's important to be open about money. It's a necessary part of life and not something to be ashamed of. Financial transparency is an important way to stay organized, keep track of your expenses, and prevent fraud.”

“I believe that being open about money is essential to building a strong financial foundation. It's important to have honest conversations about our finances in order to make sure that we are setting ourselves up for success. Financial transparency can help us identify areas where we can make improvements and help us better plan for our future. It can also provide us with additional insight into our own financial situation and give us the confidence to make smart decisions.”

“We should be open about salaries, especially since we often discover disparities based on race and gender.”

“All in all, be it salary or financial matters, transparency is good for the family and the country.”

“In my opinion, it’s important to be open and honest when talking about money. It’s a sensitive subject, but discussing it openly can help create more financial literacy and understanding. I think it’s important to set boundaries, especially when talking to family or friends, and to respect people’s privacy if they don’t wish to share certain information. Having conversations about budgeting, saving, and investing can be very beneficial for everyone involved.”

“I agree, it's ridiculous that we do not talk more about money, given that it is vital to our lives.”

Financial transparency is one of the hottest topics in business today. It builds trust, establishes a culture of openness, and boosts employee engagement. What’s more, increased pay transparency attracts and retains the best talent. Last but not least. It is also vital for narrowing the gender pay gap and for addressing other pay gap factors, such as race.

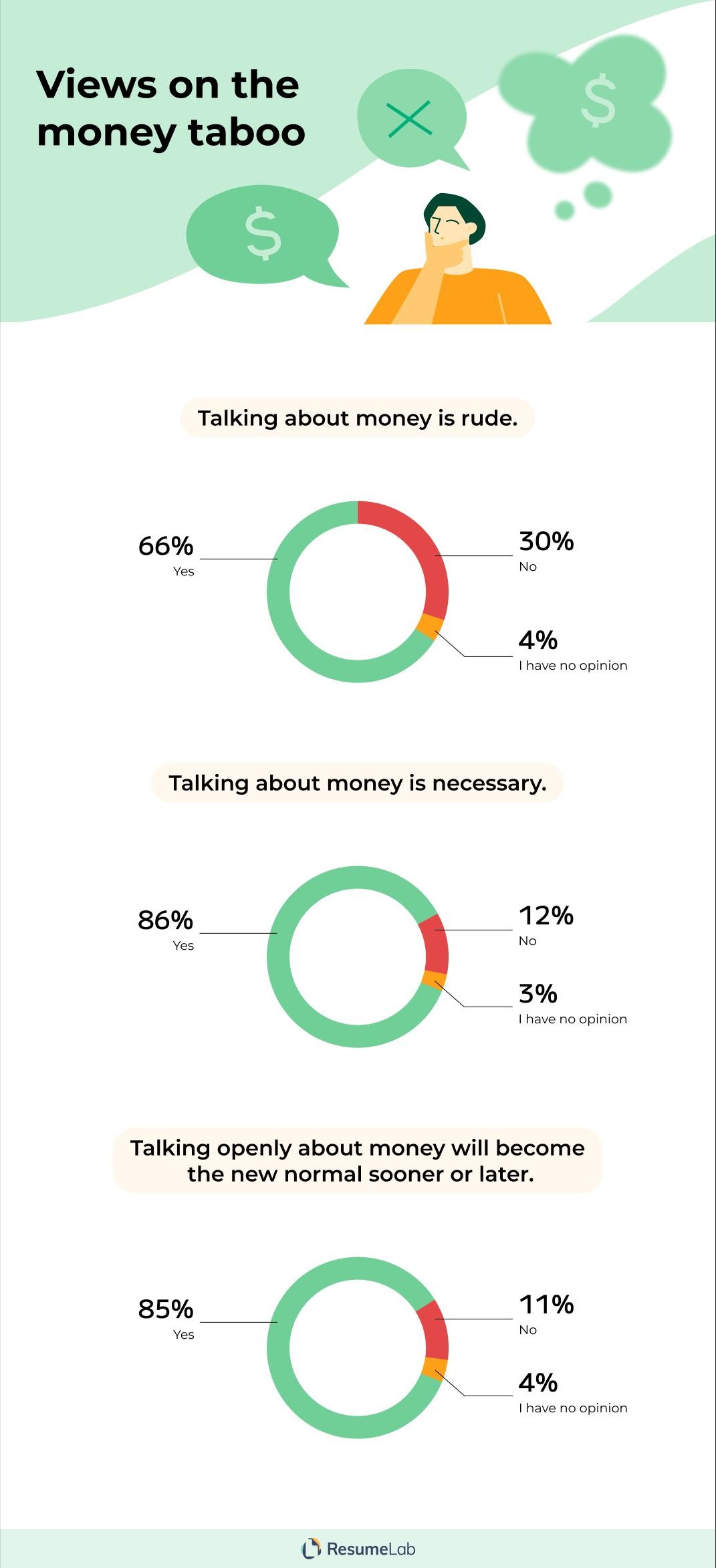

At the same time, the money taboo still exists.

What makes the money taboo so powerful is the common belief that money is a measure of status and power.

“We instinctively know that as soon as we speak the numbers, judgment will follow. It could be positive or negative, but once you’ve put a number on your debt, your savings, or your income, you’ve opened the door for specific comparisons.”

What can we do to break the money taboo, then? Well, talk.

Let’s find out what our study participants think about it.

People explore space, develop AI, create new technologies... And many still find it awkward to discuss money. Kind of a paradox.

Isn’t it high time to normalize what’s normal? Financial transparency is the answer.

Here’s a recap of our findings:

The above-presented findings were obtained by surveying 1046 American respondents online via a bespoke polling tool. They were asked questions relating to their attitudes toward money, financial transparency, and factors determining pay. These included yes/no questions, scale-based questions relating to levels of agreement with a statement, questions that permitted the selection of multiple options from a list of potential answers, and a question that permitted open responses. All respondents included in the study passed an attention-check question.

The data presented relies on self-reports from a randomized group of respondents. Each person who took our survey read and responded to each question without any research administration or interference. There are many potential issues with self-reported data like selective memory, exaggeration, attribution, or telescoping. Some questions and responses have been rephrased or condensed for clarity and ease of understanding for readers.

Want to share the findings of our research? Go ahead. Feel free to use our images and information wherever you wish. Just be transparent and link back to this page, please—–it will let other readers get deeper into the topic.

To help you choose the best resume format, let’s first understand the differences between the three main resume formats. See the examples and make an informed choice.

Mariusz Wawrzyniak

Career Expert

![How to Write a Cover Letter for Any Job [2025 Guide]](https://cdn-images.resumelab.com/pages/how_to_listing.jpg)

A cover letter can make or break your entire job application. Discover how to write a cover letter that will impress any recruiter.

Olga Ber

Career Expert

Explore my top picks from the Google Docs resume template collection and learn how to craft your own standout resume. Use a Google Doc resume that reflects your style.

Mariusz Wawrzyniak

Career Expert